INVESTMENT UPDATE: A WALKTHROUGH INTO THE NHC JOINT VENTURE POLICY 2022. HOW CAN INVESTORS BENEFIT FROM THIS?

- What are the key terms and conditions that prospective investors should be aware of?

- What are the available options for investors to venture with NHC?

- The currently available opportunities for investors to grab.

- A look into the Legal, Regulatory, and Tax implications to be considered by investors.

1. Introduction

On the 16th of November 2022, the public witnessed the launch of the new National Housing Corporation (NHC) Joint Venture (JV) Policy 2022, which was graced by the Prime Minister of the United Republic of Tanzania Hon. Kassim Majaliwa. NHC is a government parastatal with the sole function of providing and facilitating the provision of housing and other buildings in Tanzania.

NHC’s JV Policy dates back to 1993 when it started implementing such projects but has been revised over the years and currently in 2022 with the objective of improving the performance of the JV projects portfolio.

2. Key terms and conditions for the JV

According to the policy, there are a few key matters for investors to take note of as they pounder to join forces with NHC. These include the condition that:

- NHC will only deal with JV partners who have established a company/ institution and that no dealings will be made with individuals.

- Furthermore, the land offered by NHC cannot be used as collateral when the JV partner is securing a loan.

- NHC will conduct due diligence on the JV partner where a confidentiality agreement (NDA) and development bond have to be in place too.

- Project implementation period should not exceed 5 years.

3. JV arrangements available for investors

NHC has formulated four (4) main types of JV arrangements that the prospective investors can choose from as elaborated below:

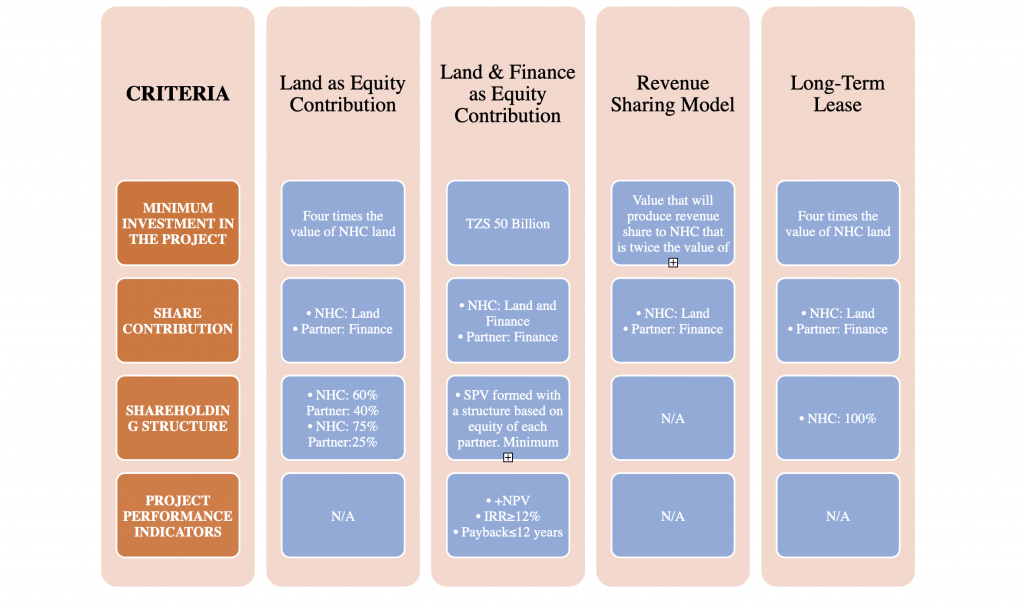

- Land as Equity Contribution – LEC

This arrangement typically involves NHC only providing land and the Partner financing the project to completion.The Partner may choose to invest with a focus on ownership of the project where the ownership structure between NHC and the Partner will be 25%:75% respectively upon completion of the project and eventually change to 60%:40% respectively after 15 years of operation.Otherwise, the Partner can choose to invest with a focus on cashflow where the ownership structure between NHC and the Partner will be 25%:75% respectively upon completion of the project and eventually change to 75%: 25% respectively after 25 years of operation.A stringent requirement under this arrangement is that the Partner’s investment should be at least 4 times the market value of NHC’s contributed land.

From the above explanations, a Partnership arrangement can be a suitable mode of operations for an effective split of the cashflows.

- Land and Finance as Equity Contribution – LFEC

This arrangement unlike the LEC above also involves NHC contributing finance in implementing the project. As such, NHC and the Partner have to agree on the shareholding structure and a formation of a Special Purpose Vehicle (SPV) in form of a limited liability company is required.For the LFEC to work, the below minimum criteria are to be met:- Total project value must be greater than or equal to TZS 50 billion;

- Internal Rate of Return (IRR) of a minimum of 12%. IRR also known as Economic Rate of Return (ERR) is a rate of return used in capital budgeting to measure and compare the profitability of investments.; and

- Payback period of not more than 12 years.

As a limited liability company is required for this particular kind of arrangement, then the JV partner is more likely to benefit from its share of dividend pay-outs declared by the company as and when profits are realized.

- Revenue Sharing Model – RSM

This mode of JV entails an arrangement where the project is built, sold and revenues obtained being shared among NHC and the partner on a pre-agreed percentage. NHC will contribute land only and the partner will finance the project to completion.For the RSM to work, the below minimum criteria are to be met:- Revenue share for NHC of at least twice the market value (at the beginning of the project) of its land contributed;

- IRR of a minimum of 12%; and

- Return on Investment of at least 15%.

As the project will have an end when all properties are sold, then either a Limited liability company or Partnership can be established.

- Long-term Lease Model – LLM

Under LLM, the JV partner will lease a plot from NHC, thus giving an opportunity to the JV partner to develop and operate the property before returning the same to NHC.For the LLM to work, the below minimum criteria are to be met:- The tenure will be at least 10 years and at most 30 years;

- Leasehold to be twice as long as the estimated payback period (between 5-15 years)

- Properties developed only to be used for commercial purposes;

- Proposed investment should be at least 4 times the market value of NHC’s contributed land; and

- NHC to get 25% of the revenue or space of the project during the first half of the leasehold tenure and 50% for the remaining leasehold.

As the project will come to an end when all properties are returned to NHC, then either a Limited liability company or Partnership can be established.

Figure 1: Matrix showing the key JV project selection criteria

4.0 Major projects amenable for JV arrangements

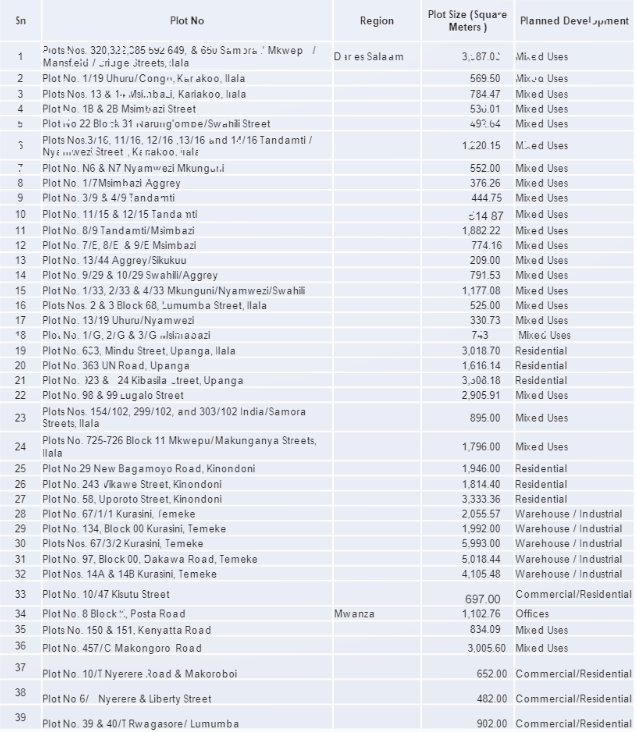

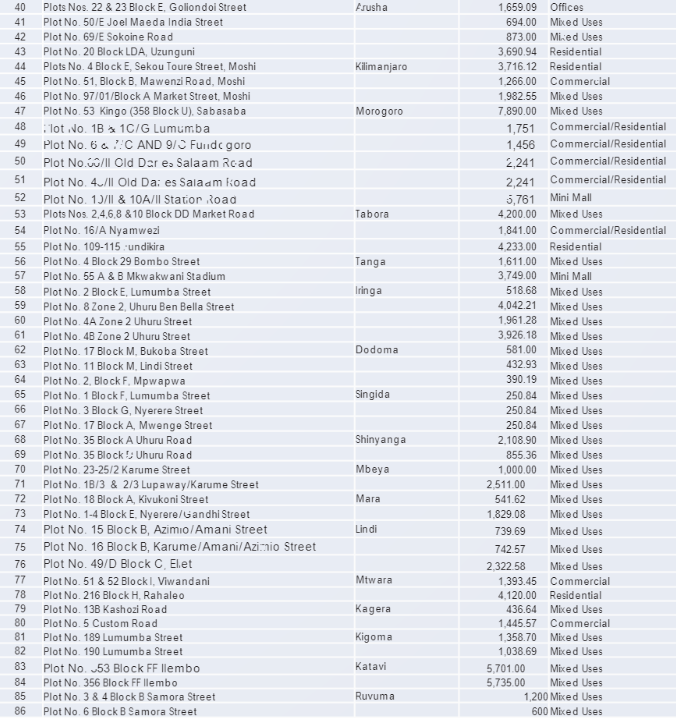

NHC has given out the first phase of JV projects whereby prospective and interested partners can look into for purposes of submitting their proposals for the development of such plots. Additionally, partners are also given room to request for other plots that are not listed in this first phase for NHC to consider in their plan.

At the moment, NHC has listed a number of plots in prime areas in various regions in Tanzania, which are planned to be developed into residential, commercial, warehouse/industrial and mixed use properties through JV arrangements with the private and/or public sector.

We have placed as Appendix 1 below, the list of the available plots for JV projects for your consideration. The full details of each plot together with the building conditions and samples of concept designs can be obtained through NHC’s website via the link here.

5.0 Legal, Regulatory and Tax implications to be considered by investors

For prospective investors, it should be consequential to understand the various tax, regulatory and legal implications of forming the JV. As NHC has specifically opted to trade with companies/ instituted, then the investor has either of the below common options:

- Incorporation/ registration of Company, Subsidiary or Branch;

- Acquisition of an existing business; and

- Acquisition of minority shares of a Company.

In effecting the above, the company has to be fully registered with the Business Registrations and Licensing Agency (BRELA) for purposes of being furnished with either Certificate of Incorporation or a Certificate of Compliance. Also registered with the Tanzania Revenue Authority (TRA) for purposes of obtaining a Taxpayers Identification Number (TIN) and VAT Registration Number (VRN). Furthermore, a business license has to be obtained, as appropriate.

Once the above entity is operational, then the process of entering the JV can be initiated by looking into the most suitable SPV, such as a Limited Liability Company or Partnership based on several factors including business structure, legal requirements, cost consideration, duration of the project, liability protection, taxation consideration, etc. In the speech that was given during the launching event, it was mentioned that NHC would form a separate entity that will be responsible for partnering with the investors in these JVs. No further details have been given on the operationality of this proposed entity, however, concerns from investors might revolve around what entity will contractually be owning the land that is to be used as equity and the bureaucracy in decision-making due to having separate entities.

It is therefore keen for an investor to properly obtain knowledge and in-depth advice on the set-up of the JV together with its implications to enable an effective and smooth operation during the project execution and avoid any undesirable output from the investment.

To add up, Tanzania has in place laws that govern Public-Private Partnership (PPP) implementations and as such, the NHC JV policy is to take shape of the regulatory and legal regimes in place. For instance, the policy provides room to take the form of unsolicited proposals which can be linked to the provisions of Section 15 of the Public Private Partnership Act CAP. 103 R.E. 2018 read together with Regulation 62 of the Public Private Partnership Regulations 2022. The policy however seems silent on this part but still maintains the autonomy of the NHC to look for the best offers or value for money. While this is good in the context of protecting the interest of the public, on the other hand this may lead to abuse in terms of corrupt practices and bureaucracy.

6.0 Conclusion

The new NHC JV policy 2022 is viewed as a welcoming opportunity to investors (both local and foreign) due to the vast options that are present and the adequate choice of project portfolios that the investor can look into. NHC should continue to provide a more favorable environment (such as proposed payback periods, regulatory requirements, technical support, tax incentives subject to engagement with other government authorities), transparency and accountability to the investors in order to attract more investment and eventually develop the real-estate space.

Appendix 1: List of Plots for JV Projects

Important Notice:

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, Breakthrough Attorneys and Advisory Services, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.